IR35 - Inclusion of private sector

This guidance highlights a change in the application of IR35 from public sector (including charities), introduced in April 2017, to cover the private sector, and encompasses the compliance and reputational risks associated with the new rules. The guidance includes the type of workers who may be involved and how the extension of the requirements will affect organisations.

The Changes

Many public-sector and charity internal audit functions will already be familiar with IR35. This legislation is designed to reduce tax avoidance through the use of intermediaries and, from 6 April 2020, will extend its reach to the private sector. An intermediary will usually be the worker’s own personal service company. They could also be a partnership, a managed service company, or an individual.

The problem IR35 aims to solve ‘the hiring of individuals through their own service companies so that they can exploit the fiscal advantages offered by a corporate structure.’ (HMRC, 1999)

Currently, the legislation applies to off-payroll working in the public sector, where the public authority is responsible for determining whether a worker falls within IR35. However, medium and large organisations will have to comply as of April 2020.

The rules make sure that workers, who would have been an employee if they were providing their services directly to the client, pay broadly the same tax and national insurance contributions as employees.

Who will be affected?

The legislation puts the bulk of the onus on the organisation engaging a worker, whether directly or through an intermediary or personal service company (PSC). (Note: ‘intermediary’ and ‘personal service company’ in this context mean limited companies, not sole traders.)

The organisation is responsible for:

- determining a worker’s status

- documenting this in a status documentation statement (SDS) and issuing it to both the worker and the PSC

- operating PAYE if the worker is deemed an employee, or if the organisation delays in issuing the SDS and

- if the worker is deemed an employee but paid through a PSC, deducting applicable taxes (such as national insurance payments) and paying them to HMRC.

The legislation also covers other parties in the employment supply chain. This means that not only the hiring organisation and the PSC, but also any other intermediaries may become liable for deducting and paying relevant taxes if they fail to discharge their responsibilities under the law.

As for small businesses, HMRC’s current stance is to exempt those falling under the small companies regime (Companies Act 2006). This means that trainers, consultants and contractors are less likely to be disproportionately affected.

What new risks does this introduce, and what does this mean for internal audit?

On the face of it, the risks facing any organisation will be those arising from non-compliance. They could lead to financial loss from having to pay back taxes and possibly penalties, and possibly reputational damage if this becomes public. Have the risks associated with this been considered and included on risk registers?

The board and audit committee may want assurance from internal audit that they are adhering to IR35 and to ensure that the organisation has made the required changes to their systems, processes and procedures.

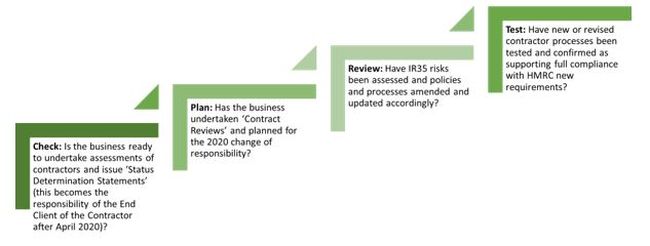

Internal audit should be asking the following:

- has the organisation undertaken a compliance appraisal of the new rules?

- are processes in place to establish whether individuals are employed or self-employed?

- do departments have systems in place to identify those working through intermediaries?

- are procurement processes in line with the legislation?

- are engagement processes updated, both for engagements through procurement and through budget-holders who can engage directly?

- is your HR department joined up with procurement? This is essential in order to apply IR35 requirements to contractors working as employees.

- does the organisation have revised systems and processes within payroll and any agencies to operate the new legislation?

- have effective and legally compliant dispute resolution processes been developed and tested?

- will there be any specific issues or requirements in respect of information sharing?

- has training been provided to staff?

Keep in mind that this is not simply about procedures and processes. The way in which organisations apply IR35 could have broader implications for their reputation. By educating and equipping their HR, legal, payroll, accounts payable and procurement teams properly, good organisations will treat both direct employees and contracted workers fairly, while also ensuring they comply with tax law. This will enhance any organisation’s public image and help make its corporate social responsibility (CSR) statement more authentic.

Organisations that are not up to date, or who do not understand the law, could face severe unintended consequences such as payment of the tax and national insurance contributions due, as well as any interest due on these amounts and possibly penalty charges. The penalties are applied in accordance with Schedule 24 of the Finance Act 2007.

Many organisations, and departments within them, depend on specialist consultancy or other services, often provided by small businesses or even sole traders. As stated above, IR35 does not focus on small companies and sole traders. However, some organisations, including third-party companies to whom they have outsourced procurement, treat them as though they do. This may be a misunderstanding, or even a misplaced belief that this will guarantee compliance. But it brings serious risks.

An organisation that bars sole traders or requires small businesses to work only through larger ones, risks reducing (and alienating) its available pool of suppliers. It may also breach its own CSR policy. Consider how many organisations claim to use small, local companies, thereby supporting regional business and reducing environmental impact. If, through misunderstanding IR35, they cut their local suppliers off, they may risk significant reputational damage.

Consider all these points when you review IR35 compliance now, and after 6 April 2020. Is your organisation – and its intermediaries – using IR35 to do the right thing? There’s no reason not to!

Further reading

HMRC - Prepare for the changes to the off-payroll working rules (IR35)

HMRC - Understanding off-payroll working (IR35)

ICAEW - TAXguide 14/19: IR35 New tax rules

Accountancy Age - New IR35 briefing offers support for businesses and comfort for contractors

CIPD - Employment status Q&As